Top 4 Must-Haves for Reliable and Secure Biometric ATMs

From cards with embedded microchips to contactless mobile cash withdrawal, ATM authentication technologies have made great strides since self-service banking was introduced in the late 1960s.

Unfortunately, ATM fraud is still rampant, costing the industry billions of dollars each year. How can financial institutions ensure that the person attempting a transaction is a legitimate customer? PINs and passwords are cumbersome and prone to theft. Cardless ATMs, which use text messages and banking apps to verify users’ identities, are convenient but still insecure.

Fortunately, biometric ATMs provide a fast, secure answer to the question of who is actually attempting a transaction.

Biometric Authentication: A Seamless Way to Balance Convenience and Security

From the customer perspective, using your face or fingerprint to authenticate your identity is simple and convenient. Biometric ATMs can also prevent many common types of attacks — from skimming to shoulder surfing — without requiring people to carry or remember anything. In Brazil, virtually all ATMs feature biometric authentication. The technology also enjoys a high level of adoption in countries like Japan and India. Thanks to technological advances, other regions are catching up quickly.

Biometric authentication solutions are more accessible than ever. Not all of these technologies are equally secure, however. Experts have used wood glue to trick fingerprint scanners and have built wax hands to bypass vein authentication systems. Meanwhile, many consumers are concerned about their bank’s ability to keep their data safe.

To build biometric ATMs that are both secure and convenient for users, banks must focus on incorporating four key items:

- Sensor Reliability — ATMs are everywhere, from bank lobbies to dense city sidewalks. Biometric sensors must therefore be capable of operating reliably under a broad range of real-world conditions. Top solutions, like HID’s Lumidigm® single finger reader, leverage multispectral imaging (MSI) technology, which uses multiple sources and advanced polarization techniques to capture information deep within fingers and faces to recognize people even in environments that are dirty, dark or rainy.

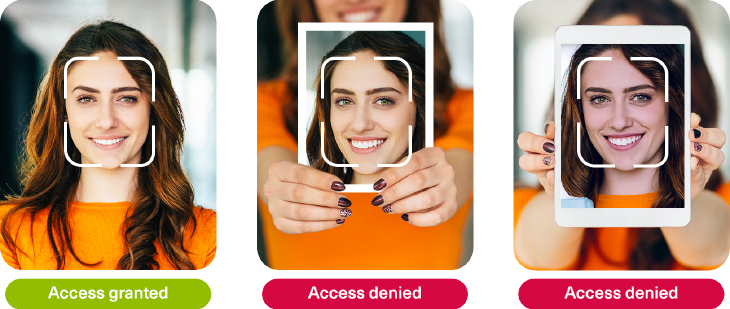

Liveness Detection — Fraudsters have recreated fingerprints from photographs and used masks to trick facial recognition systems. Sophisticated liveness detection systems are critical to preventing this type of scam, but they can’t get in the way of the customer experience. The best systems combine advanced presentation attack detection (PAD) technologies with AI and machine learning algorithms that can adapt to emerging threats to offer behind-the-scenes protection.

Image

Liveness detection technologies can identify whether or not a face or fingerprint belongs to a live person who is present at the point of capture. - Tamper Protection — By now, the threat of hidden cameras and card skimmers is well known to both consumers and financial institutions. Biometric authentication systems must be resistant to this kind of attack with technologies that are transparent to users. They must also safeguard user data with cryptographically secure storage in between the endpoints to prevent man-in-the-middle attacks.

- Privacy Protection — Consumers today are increasingly concerned about data privacy. To protect people’s personal information from theft and misuse, the best biometric vendors offer robust, secure mobile enrollment systems that facilitate matching at every customer touchpoint — from mobile apps to branches and ATMs — while remaining compliant with Know-Your-Customer (KYC) regulations.

The goal of any ATM transaction is to conveniently provide bank services while ensuring the identity of the individual to whom the service is being provided. Biometric authentication using fingerprint, facial recognition or a combination of both, allows easy, fast and secure access to ATMs. We no longer have to choose between greater security or convenience — with biometrics we can have both.

Biometrics boost convenience and security at ATMs. To learn more, read our eBook, Improving the ATM Experience With Biometrics Multi-Factor Authentication >>